The replacementdouble entry system was fielded in early 1996 andhas never lost a transaction(although there have been some close shaves [IG1]). If companies were to publish balance sheets without income statements there would be no way for investors to scrutinize the changes in equity with a single entry system. All you would have to do is remove a line in the ledger and that money no longer exists, there would be no way to verify, no way to audit, no way to reconcile for people to agree. Likewise, it would be nearly impossible to build a single entry system, that by itself will not support the reporting needs of public corporations companies that sell shares of stock to the public. The development of double-entry accounting opened the realm of accounting into a whole new world.

Implementing Triple Entry Accounting as an Audit Tool—An Extension to Modern Accounting Systems

Plus, with blockchain technologies such as Ethereum, you’re able to restrict access to the parties to the transaction. I look forward to seeing what’s next as this technology evolves and reaches widespread adoption. The ability to utilize a blockchain that records all information related to a particular transaction in real time and between multiple parties is incredibly powerful. The applications for automating business processes, particularly around payments and controls, are seemingly endless. For this reason, a common misconception has come up that the writing of each piece of information to the blockchain is actually a third entry. From those foundations, Boyle concluded thattherefore what is needed is a shared access repositorythat provides arms-length access.

Posting a three column cash book to ledger accounts

We term this triple entry bookkeeping.Although the digitally signed receipt dominatesin informationterms, in processing terms it falls short. Doubleentry book keeping fills in the processing gap,and thus the two will work better togetherthan apart. In this sense, our term of tripleentry bookkeeping recommends an advance inaccounting, rather than a revolution. Likewise, the company DigiCash BV of the Netherlandsfielded an early digital triple journal entry cash system into a bank inthe USA. During its testing period, the originalsingle entry accounting system had to be fieldreplaced with a double entry system for the samereason – errors crept in and rendered the accountingunderneath the digital cash system unreliable. In this example, the company would debit $30,000 for the machine, credit $5,000 in the Cash account, and credit $25,000 in a Bank Loan – Accounts Payable account.

REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems

- The idea is that accounting could be fundamentally tied to forecasting and, therefore, enable better strategic decision making.

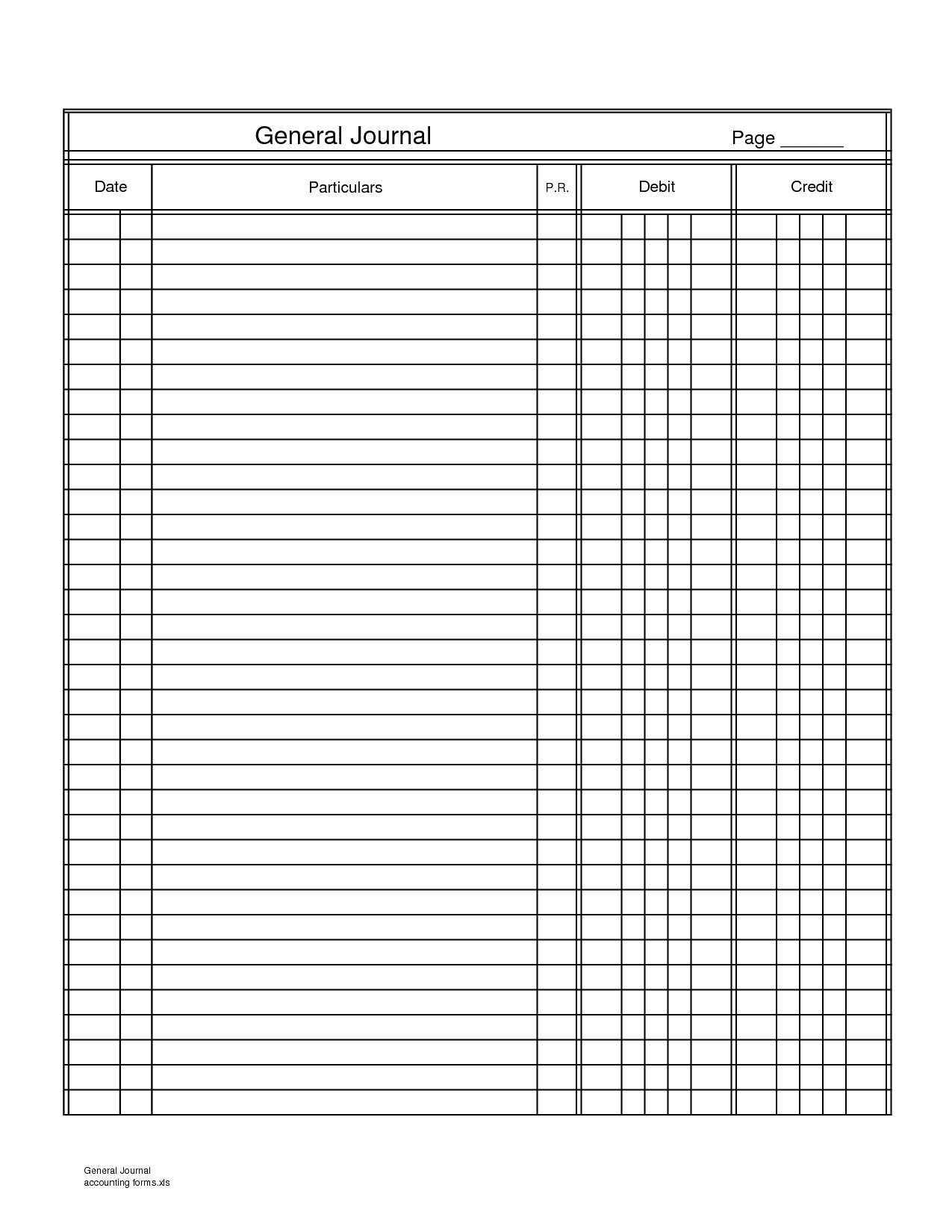

- Local Entry Storage and Reports.The persistent saving and responsive availabilityof entries.In practice, this is the classical accountinggeneral ledger, at least in storage terms.It needs to bend somewhatto handle much more flexible entries,and its report capabilities become more keyas they conduct instrinsic reconciliationon a demand or live basis.

- Thus, assets are decreased and immediately increased resulting in a net effect of zero.

- The general journal is an initial record where accountants log basic information about a transaction such as when and where it occurred along with the total amount.

- Double-entry bookkeeping means that a debit entry in one account must be equal to a credit entry in another account to keep the equation balanced.

- If you are an accountant or auditor, staying ahead of the curve and getting certified in blockchain is essential.

The Excel-based system makes project control charting easy, even for those with little or no background in statistics. Triple entry accounting is an enhancement to the traditional double-entry system in which all accounting entries involving outside parties are cryptographically sealed and linked through a transaction within a third entity but to understand the value of this we need to appreciate a little bit the history of accounting systems. A blockchain is a digital ledger that is distributed among multiple locations to ensure security and ease of access globally. Currently, the primary use of this technology is for bitcoin and other cryptocurrencies but blockchain will entirely disrupt accounting processes as we know them — it’s only a matter of time. A smart contract is a self-executing contract with the terms of the agreement between buyer and seller written into code.

Bookkeeping supports every other accounting process, including the production of financial statements and the generation of management reports for company decision-making. Double-entry bookkeeping is used to minimize accounting errors and to keep the books in balance. A compound entry is necessary when a single transaction affects three or more accounts. Suppose the company’s owner purchases a used delivery truck for $20,000 on August 6 by making a $2,000 cash down payment and obtaining a three‐year note payable for the remaining $18,000. This transaction is recorded by debiting the vehicles account for $20,000, crediting the notes payable account for $18,000, and crediting the cash account for $2,000. Double-entry accounting is a method for booking journal entries to reflect financial activity by updating two or more accounts with equal and opposite debits and credits.

Rather, it was developed through the collaborative efforts of a community of researchers and developers. While the exact origins of blockchain are difficult to pinpoint, the first successful implementation of Blockchain was created by Satoshi Nakamoto in 2009 as part of the cryptocurrency Bitcoin. Since then, numerous other blockchain-based applications have been developed, each with unique features and use cases. In that case, it may be worth considering specializing in blockchain technology and learning how to use this new technology for businesses. Each “block” in the blockchain contains a record of all the transactions that have taken place on the Bitcoin network since the block was created. This means that there is a permanent and public record of all transactions, which helps to prevent fraud and double spending.

Fundamentally, thisrepository is akin to the classic double-entry accounting ledgerof transaction rows (“GLT” for General Ledger – Transactions),yet its entries are dynamic and shared. The principles of Relational Databasesprovide guidance here.The fourth normal formdirects that we store the primary records,in this case the set of receipts, and weconstruct derivative records, the accountingbooks, on the fly [4NF]. First, ensurethat all entries are complete, in that they refer totheir counterpart. This simple strategy created arecord of transactions that permitted an accountancyof a business, without easily hiding frauds in thebooks themselves.

Paperwork reduces dramatically,as the records of the money system are reliableenough to quickly resolve questions even yearsafter the event. Far from reducing the relevance of this workto the accounting profession, it introducesdigital cash as an alternate to corporatebookkeeping.If an accounting system for a corporation orother administrative entity is recast as asystem of digital cash, or internalmoney, then experience shows thatbenefits accrue to the organisation. The capabilityto detect, classify and correct errors is even moreimportant to computers than it is to humans,as there is no luxury of human intervention;the distance betweenthe user and the bits and bytes is far greaterthan the distance between the bookkeeper andthe ink marks on his ledgers. In the opinion of this author at least, singleentry bookkeeping is incapable of supporting anyenterprise more sophisticated than a household.Given this, I suggest that evolution of complexenterprises required double entry as an enabler. A blockchain currency is a digital asset that is created through the process of mining and uses a blockchain to track its ownership. Bitcoin, Ethereum, and Litecoin are all examples of blockchain currencies.Blockchain currencies are decentralized, not subject to government or financial institution control.